The regulation of cryptocurrencies has been a hot topic in the industry for several years. Stricter regulation of the industry may mean that companies in this field will find it difficult to carry out their day-to-day activities, which will undoubtedly have an impact on their operations.

As a cryptocurrency exchange, we at Bintense are always up to date with the latest regulatory requirements. We also believe that the best way to ensure optimal exchange conditions for our clients is to keep them up to date with all cryptocurrency-related news, especially when it comes to BTC and ETH prices.

Today, we’d like to talk more about MiCA, a regulation drafted by the European Union that will undoubtedly have an impact on cryptocurrency users and fintech companies across Europe, like us.

What is MiCA?

MiCA stands for Markets in Cryptoassets Regulation. It is a set of rules drawn up by the European Union (EU) to regulate cryptocurrencies and everything related to them. Just like the rules that apply to regular money, such as how banks operate and how money is handled, MiCA creates rules for digital money or cryptocurrencies.

These rules help to protect those who use cryptocurrencies and ensure that these digital currencies are used safely. The MiCA covers aspects such as how new cryptocurrencies are created, how they are bought or sold, and what rules need to be followed when dealing with cryptocurrencies.

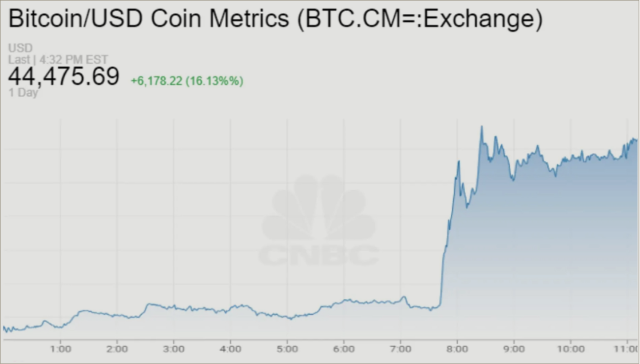

The volatility of BTC and ETH prices encourages people to buy these instruments, and the EU has been worried for some time about the lack of consensus when it comes to regulation, so MiCA’s initiative was not really a surprise.

It also aims to prevent bad practices such as fraud and illegal activities related to cryptocurrencies. Overall, the MiCA is a set of instructions aimed at ensuring the fair and safe use of cryptocurrencies in the EU.

MiCA’s impact on BTC and ETH prices

Our exchange facilitates services for people who want to buy Bitcoin and Ethereum. It is important to monitor the prices of BTC and ETH, as you should always monitor them before buying or selling these coins.

On the face of it, MiCA is not intended to undermine the crypto industry, but rather to introduce a harmonised regulatory framework. Cryptocurrency companies have found it difficult to comply with the regulations, which have so far been different across Europe. So the main objective here is first and foremost to unify.

The European Council justified the need for new rules by stressing the importance of protecting Europeans when buying cryptocurrency assets. Bintense follows European rules, which means that if regulatory requirements change, we are committed to adapt accordingly.

Requirements for cryptocurrency companies

The news rules under MiCA cover issuers of utility tokens, asset-linked tokens and stable coins. At the same time, they also apply to service providers, including exchange venues and money service providers. Following the announcement of the MiCA, BTC and ETH prices have not reacted sharply, which is good news for cryptocurrency users. What will happen once these rules are de facto in place remains to be seen.

More specifically, MiCA increases transparency and provides a comprehensive framework for issuers and service providers. It is no secret that part of the concern about cryptocurrencies is their negative image as fraudsters and facilitators of fraud, and MiCA can certainly help to improve the reputation of digital assets. We at Bintense are therefore very optimistic about the changes it will bring and are naturally committed to any new policies that come with MiCA.

We also believe that this regulation can help the industry to further mature and help companies to operate in a transparent way.