Understand the factors influencing cryptocurrency prices

Cryptocurrencies have become very popular in recent years, attracting both businesses and individuals. However, their prices can be highly volatile, so it is important to understand the factors that cause them to fluctuate. As we delve deeper into the world of cryptocurrencies, it becomes apparent that their prices are influenced by a range of elements, from market demand and uptake to technological advances and regulatory factors.

Vytautas Kelminskas, CEO of Bintense, a new secure and fast online cryptocurrency exchange, stresses that businesses need to understand the underlying dynamics of cryptocurrency markets:

“Understanding the drivers of cryptocurrency prices is crucial to making informed decisions and navigating the ever-changing digital asset landscape.”

Market demand and acceptance

Demand for cryptocurrencies plays an important role in determining their prices. As more and more individuals and companies adopt cryptocurrencies, their value tends to increase.

“The growing acceptance and adoption of cryptocurrencies by businesses and individuals is contributing to an increase in demand, which in turn affects their prices,” says Vytautas Kelminskas.

In addition, consumer sentiment plays a crucial role in shaping cryptocurrency prices. Positive or negative market news, regulatory changes and economic conditions can affect user sentiment and thus the value of cryptocurrencies.

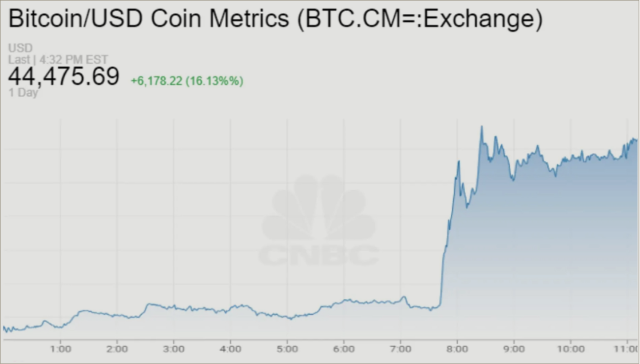

In February 2021, the price of Bitcoin skyrocketed after Tesla, the electric vehicle company led by CEO Elon Musk, announced it had acquired Bitcoin worth $1.5 billion. The news shocked the market and sparked a surge in the price of Bitcoin.

“Tesla’s interest in Bitcoin was an indication of its faith in the cryptocurrency and was seen as confirmation that it could become a widespread asset. The announcement sparked a wave of positive sentiment among cryptocurrency enthusiasts, increasing demand for Bitcoin and driving up its price.

Following Tesla’s announcement, the price of Bitcoin has risen significantly, jumping by more than 10%, pushing Bitcoin above its previous all-time high and to a new record level. This news has increased the global interest and curiosity of users in cryptocurrencies around the world.

Technology and innovation

Technological advances and innovation are the driving forces behind cryptocurrency prices.

Improvements in blockchain technology and the development of new protocols can have a significant impact on the value of specific cryptocurrencies. As blockchain technology improves, there is a chance that cryptocurrencies using advanced solutions may increase in value.

In addition, planned network upgrades, such as protocol upgrades or scalability solutions, can generate positive sentiment and price increases. Users often monitor such updates as they can increase the efficiency and scalability of a particular cryptocurrency.

Market manipulation and speculation

Market manipulation and speculative trading can have a significant impact on cryptocurrency prices.

Large holders of cryptocurrencies, often referred to as “whales”, can influence prices by placing large buy or sell orders. The actions of these influential individuals or entities can cause large price fluctuations.

Consumers need to be aware of these risks and be careful when buying or selling.

Regulatory environment

The regulatory environment has a significant impact on the value and stability of cryptocurrencies.

Government regulation and actions by financial institutions can have both positive and negative effects on cryptocurrency prices. Regulatory measures can encourage adoption by providing a framework for cryptocurrency businesses to operate safely. However, uncertainty or restrictive rules can have a negative impact on prices.

Legal recognition and regulatory clarity can influence cryptocurrency prices by increasing market confidence. Clear guidelines and frameworks can attract more participants and instil confidence in the market.

Understanding the drivers of cryptocurrency prices is crucial for companies navigating the dynamic digital asset space. Vytautas Kelminskas, CEO of Bintense, says: “The cryptocurrency market is highly volatile and prices can experience large fluctuations that can lead to profits or losses. It is important to note that the value of cryptocurrencies can be highly volatile and even a loss in value is possible. At Bintense.io, we prioritise risk awareness and provide detailed information on the risks of buying or selling cryptocurrencies.”

By analysing the factors driving cryptocurrency prices, users can learn about market demand and acceptance, technological advances, market manipulation and speculation, and the regulatory environment. Bintense.io, a reliable and convenient cryptocurrency exchange, is a platform where users can exchange cryptocurrencies quickly and securely.

Remember that the cryptocurrency market is dynamic and constantly changing. Therefore, users need to keep an eye on the market and events that may affect the price of cryptocurrencies in order to make informed exchange decisions.