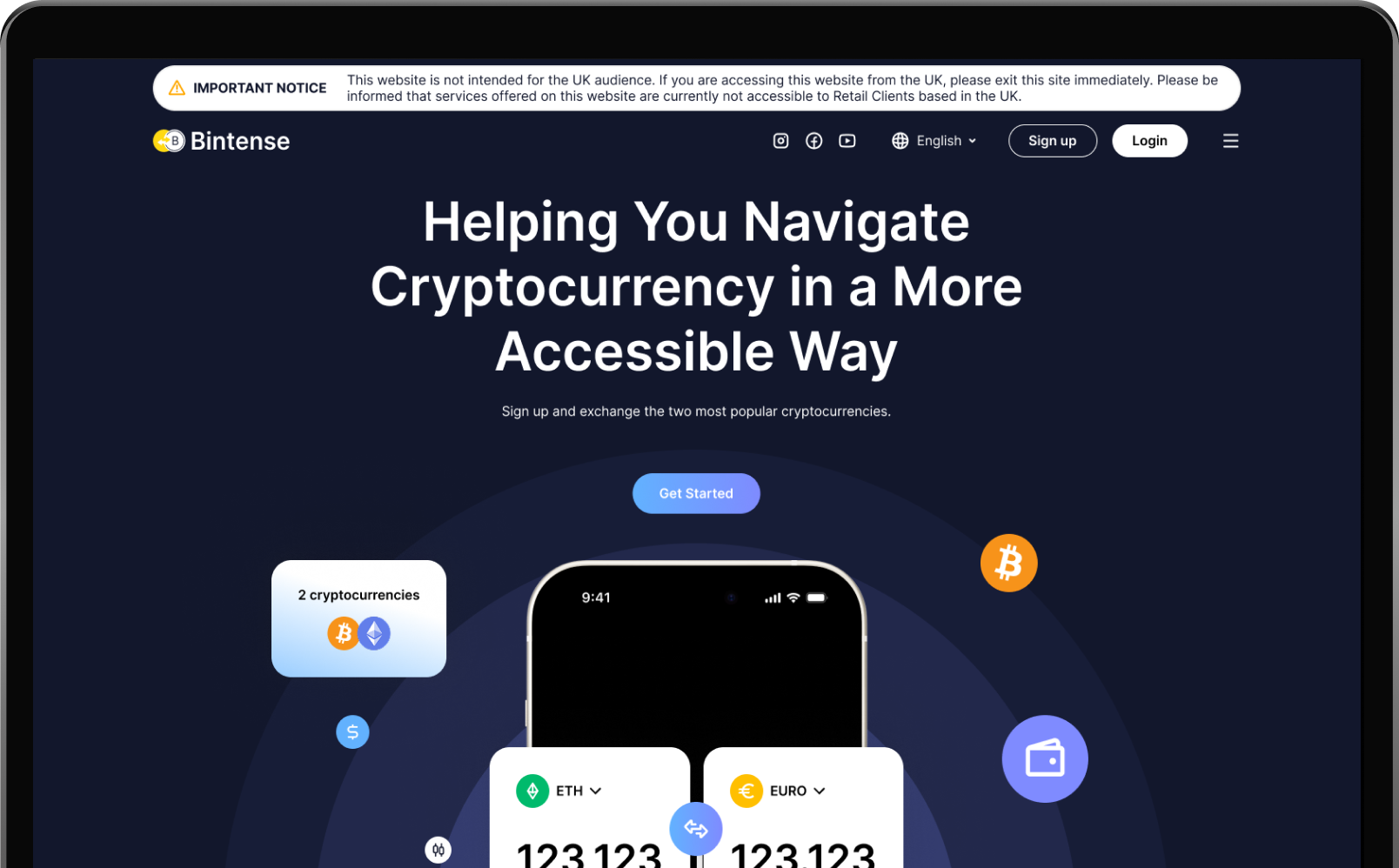

Siekiame nuolatinių

patobulinimų efektyvumo, saugumo ir vartotojo patirties srityse mūsų kriptovaliutų keityklos platformoje. Naudojamos pažangios technologijos užtikrina spartesnius ir skaidresnius sandorius visiškai saugioje bei teisės aktus atitinkančioje aplinkoje.